Cash is the fuel that makes a business run.

You need it to pay salaries (including your own), fund marketing programs to acquire and retain new customers, invest in equipment and facilities, pay rent, buy supplies and many more day-to-day activities.

The purpose of this post is to help you figure out how much cash to have in reserve — how much is enough. Most financial experts recommend three to six months of operating expenses, but using this for every business in every situation is misleading.

To determine how much cash you need, you must look at the following key areas:

How much cash have you been using?

If you’re an established business owner, look at your monthly cash flow report (or go to the next paragraph if you’re a start-up). This report will provide a historical and seasonal perspective. Note the cash received from sales and the cash spent. The net of these two is often referred to as the “net burn rate.” For example, if you have $50,000 in sales and $30,000 in expenses, your net burn is +$20,000.

Your “gross burn rate” only takes cash expenditures into account; in our example, that’s $30,000 and is the more conservative amount, since it does not assume any sales are made. Historical spending patterns are a good starting point in considering future spending plans.

How much cash do you plan to use?

Look at the monthly cash flow projection covering the next 12 to 15 months. If you’re an established owner, you can find this information in your monthly budget, or if don’t have a budget, from a financial forecast created for this purpose. For start-ups, you’ll find your answer in the financial section of your business plan. As you did with actual cash expenditures in the preceding paragraph, look at the sales (cash in) and expenditures (cash out) separately.

Be conservative in your forecast as actual results often differ from what’s stated in your business plan. And keep in mind that expenses are usually more predictable than revenue because many are relatively fixed, such as payroll and rent (often the two largest expense categories). And for start-ups, separate the one-time upfront costs needed before you can open your doors from your ongoing operating expenses.

For a small business, the past is not necessarily the best predictor of future needs. You need to consider the stage of your business in your forecasts.

What stage is your business in?

Are you in start-up, first year of operation, maintaining an ongoing steady business, or do you have plans to grow or make large purchases? Each of these will impact the cash forecast discussed above. While an established business may have good benchmarks, a start-up has few benchmarks and the most uncertainty, and thus should be more conservative when setting cash flow needs.

In growing businesses, accounts receivables, and maybe inventory, expand to support the increased sales. But it is often overlooked that you need cash to fuel this growth — you must spend money to generate the sale before the customer remits cash.

How long will it take to get more cash?

Now you know your cash needs for the next 12-15 months. The next consideration is how long it will take to get more cash if and when it is needed. If you’re funding the business from your own resources, the time is short. Getting the needed funds likely means writing a check from a bank account or selling a security from an investment account — maybe three to five days until the cash is available to use.

However, if you need a bank loan to get cash, it might take two months — one month to find a bank willing to make the loan and one more month to do the paperwork. This option assumes you have a business plan in almost-ready condition and have maintained good relations with your bank if you have an established business or on your personal account if you’re in start-up mode.

Raising funds from angel investors extends the time considerably. If you go this route, count on six to nine months to prepare the business plan/investor pitch, make presentations to several angel groups to find one that is interested and a good fit, and wait while the angel group conducts its due diligence.

Once you know how much cash you’ve been using, how much you plan to use, and how long it will take to get it, you can determine how much cash you need to keep in the business. For example, if you plan to use a bank loan to fund your cash needs and you plan to spend $50,000 a month then you should probably keep $100,000 in your bank account — if you have certain sales revenue occurring in these two months you can reduce the needed cash in the bank by a like amount. However, if you plan on using angel funding then you might want to have $300,000 in your bank account.

Before approaching a bank or angel group consider some other funding sources

Are there other cash sources?

There are many other sources of cash. For purchases, ask the vendor for credit terms or a longer period in which to pay. For sales, ask customers to pay you in shorter timeframe and offer a discount as an incentive to pay earlier. Other cash sources include increasing your credit card balances, taking out a home equity loan, borrowing from family and friends, tapping into savings and retirement accounts, leasing rather and purchasing equipment — the list goes on. It’s also good practice to have a bank line of credit as a safety net — one that can be dipped into when needed.

When is the best time to seek more cash?

A common axiom is that the best time to obtain funds is when you don’t need them. Sounds counterintuitive, but during these times you aren’t desperate to take the only offer made. You have time to shop for the best source, with the best terms, and you can negotiate from a position of strength.

Too much or too little cash

There are many lists of common reasons for business failures. The two items frequently near the top are undercapitalization (not enough cash) and overcapitalization (too much cash). The first reason is pretty easy to understand. But companies can also get into trouble when they have too much cash, as they often undertake projects, hire staff, buy equipment, move to larger offices, and partake in other such expensive actions, which incur ongoing implications like fixed costs.

Often these decisions are not made with the same planning rigor when cash was tighter. If your company is fortunate enough to have “excess” cash beyond the forecasted needs, then make a distribution to the owners rather than make a decision that may have far-reaching effects.

Key Lessons

- Know how much cash you’ve spent and how much you plan to spend.

- Determine where you will obtain cash if and when it is needed, and how long it will take to get it.

- Match lessons 1 and 2 to determine how much cash you need to retain.

- Understand the stage of your business to determine if modifications to historical spending patterns are needed when considering forecasts.

- Be conservative in your estimates, rarely do actual results match forecasts.

- Seek cash when you are in a position to explore options and negotiate from strength.

Next Steps

- Update your business plan, budget, and financial forecasts so they give you good information now and are available if and when they are needed.

- Research funding sources for future use.

- Go to your bank and explore getting a line of credit so you have a safety net if and when it is needed.

Hal Shelton’s business planning skills were developed as a certified SCORE small business mentor, corporate executive, nonprofit board member, early-stage company investor, and author of The Secrets to Writing a Successful Business Plan: A Pro Shares a Step-By-Step Guide to Creating a Plan That Gets Results. Suggestions for additional topics are welcome: email Hal directly from his website: www.secretsofbusinessplans.com.

We all know how important December is for the nonprofit sector. Nearly a third of all donations come in the final month of the year.

January, however, is typically a slower time for development professionals, a time to review and plan for the future. For many nonprofits, the New Year is kind of the off-season.

But any serious athlete will tell you that the off-season can be an invaluable chance to improve. Now is the time to brush up on your skills and perfect your best moves.

Fundraising appeals, from emails to website call to actions, always have room to improve.

We’ve compiled five ways to hone your fundraising appeals to set your organization up for its best year yet.

Let’s dive in!

1. Mobilize your appeals

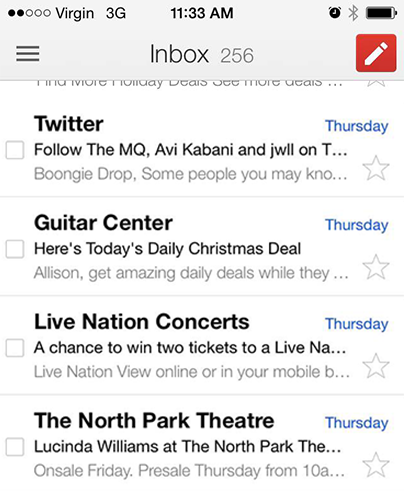

The importance of mobile cannot be overstated. 66 percent of emails are now opened on a mobile device and as many as 80 percent of people will simply delete an email that isn’t optimized for mobile viewing.

Whether it’s your homepage, donation page, or an email appeal, the public now expects to be able to view anything on their phone. Don’t give potential donors a reason to ignore you.

Fortunately, email services like Constant Contact offer email templates that you can use to easily design emails that look great on mobile.

Subject lines are also an important consideration in terms of mobile-friendly emails. Many email apps show as few as 35 characters in subject lines, so keep it short and sweet.

2. Segment your audience

Your donors may share an interest in your cause, but that doesn’t mean they’re one homogenous group. Big donors, small donors, first-time donors, and monthly donors have different interests, preferences, and budgets.

Crafting appeals that speak to these conditions will appear more informed and personal.

Even if you start on a broader level, say, by only segmenting donors who have given more than $500 from the rest, it can make a difference. Many people will give one of your suggested giving levels, so if the highest is $250, you may be leaving money on the table with bigger donors.

From there, you can get more sophisticated to give donors a better experience and raise more funds.

3. Emphasize recurring giving

The New Year is a great time to emphasize recurring giving. People are planning for the future and thinking about their resolutions.

Take a look at your appeals and make sure donors are given the option for a monthly commitment. Besides making it easy for donors to turn a one-time donation into a monthly gift, you should also write an appeal specifically explaining the need for recurring support.

Even a small monthly donation quickly adds up. For example, someone who gave $25 last year might be willing to give $10 a month this year. By the time 2016 rolls around, they’ll have given almost 5 times what they did the year before.

4. Make your call to actions pop

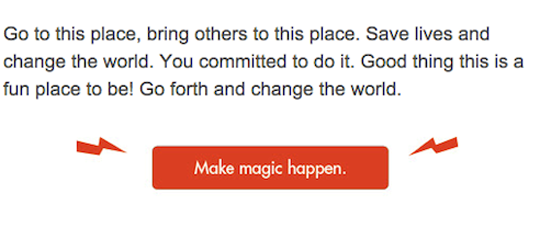

Many times, the gateway to donation is a call to action (CTA) button, so it makes sense to spend some time optimizing it. The most basic principle of CTAs is that the viewer shouldn’t have to guess where you want them to click.

Some of the elements that can help a CTA be successful are the size, color, and placement. A CTA should be big enough that it is noticeable, but not overwhelming to the page. While there is no one perfect CTA color, it should stand out from its background. Most nonprofits place the “donate” button in the upper right-hand corner of their website, but there are other options.

In email appeals especially, consider making your CTA the centerpiece, as in this ask from Liberty in North Korea.

5. Make it visually appealing

A final element of your appeal that you should consider revamping is its imagery and overall appearance. You now have more options than ever to dress up an ask and make it look good. Even email templates allow for a lot of creativity.

We already know that Facebook posts with images garner 39 percent more engagement and adding a photo to your tweet gives a 35 percent boost in retweets. Findings like these suggest that adding striking photos to your appeals could increase engagement with them.

This appeal for monthly donors from Possible Health explicitly shows how a recurring gift will help (and the brightly colored CTA is front and center!).

Another great option is to create icons that help readers visualize the problem you are tackling (or, on the flip side, the impact you are making). This example is from Pencils of Promise’s holiday campaign website. Also notice that their CTA, “I want to change this,” speaks directly to the question “Why build schools?”

Whether it’s a photo, infographic, or video, a visual element can help potential donors feel a connection to your work. By balancing compelling visual imagery with strong copy, you can create an appeal that engages and speaks to the audience at many levels.

Start strong in the new year

You don’t have to tackle everything at once, but it’s helpful to create a list that prioritizes the areas in which you might need the most improvement.

The New Year is a great time to assess the performance of your emails and website and create a to-do list for the rest of the year. By the time spring fundraising comes around, your appeals will be stronger than ever!

Crafting the perfect survey question isn’t just about what you ask; it’s also about how you ask the question.

The types of questions you decide to use can have a major impact on the insight you’re able to gather, and could be the difference between an online survey that helps you make a more informed business decision and one that leaves you with more questions than when you started.

There are two primary types of questions you can ask in a survey: open-ended and closed-ended questions.

This post will take you through when you should use each question type.

Open-ended questions require your customers to answer the question in their own words.

For example, you might ask, “What did you enjoy the most about your visit today?” Or, you might inquire, “Why have you used our services in the past, but are no longer using them today?”

Open-ended questions give your customers the opportunity to:

- Use their words to give you feedback

- Reveal the strength of their opinions

- Phrase their comments and feedback in a way that you did not anticipate

- Give accurate representations of personal views

However, there are some limitations to open-ended questions:

- Responses may vary in quality and length

- Unmotivated customers may not take the time to reflect and give you detailed feedback

- Analyzing data can be time consuming and can result in the loss of some of the rich insights and details that comments can provide

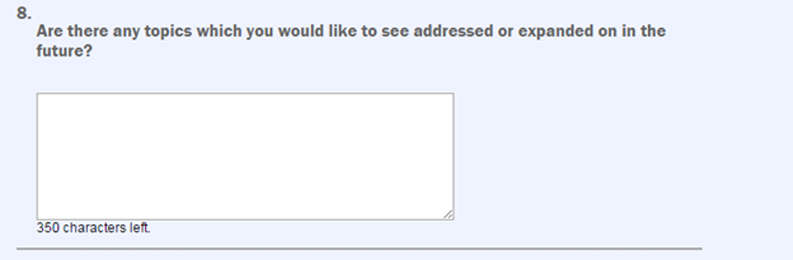

Here’s an example of an open-ended question from an event follow up survey:

In summary, you should use open-ended questions when you aren’t sure what response options to put down or you are looking for unprompted, detailed feedback.

Open-ended questions can also be great follow up questions, to ask your customers why they chose a particular response in a closed-ended question.

Closed-ended questions require your customers to choose from a list of responses that you provide.

For example, a small business curious about customer satisfaction might ask “How satisfied are you with our product?” with five responses options including: Very Satisfied, Satisfied, Neutral, Dissatisfied, and Very Dissatisfied.

Closed-ended questions give your customers the opportunity to:

- Easily answer the question since response options are provided

- Answer quickly

Closed-ended questions are also faster to summarize and analyze. You can look at what percentage of your customers selected each answer choice, or make a comparison between how two groups of customers answered a closed-ended question.

The limitations to closed-ended questions might include:

- Uninterested customers may make a random answer choice selection decreasing the survey’s reliability

- Customers may feel frustrated having to make a choice between limited options.

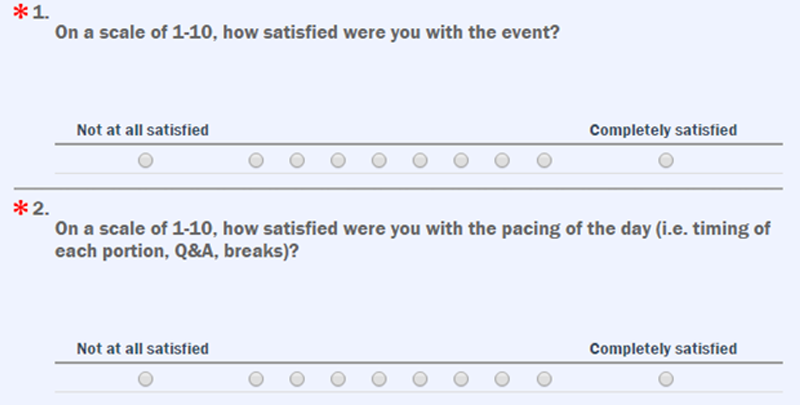

Here’s some close-ended questions from the same survey:

In summary, you should use closed-ended questions when you have a decent understanding of the attitude or behavior you are seeking to investigate and can come up with a set of response options for the question you are asking. Including an “Other” category will help alleviate any frustrations your customers feel when they are asked to select between limited choices.

Deciding when to use an open-ended and when to use a closed-ended question is an important part of survey design. If you consider the opportunities and downsides of each question type, you will be on your way to collecting high quality data that your small business can use to drive marketing decision making.

Have additional questions about creating a survey for your small business? Post your questions in the comments below.