It’s easy to think of accounting or recordkeeping as a “necessary evil,” created and maintained to satisfy government reporting — primarily taxes.

But the fact is that beyond being something you’re required to be doing under the law, accounting and recordkeeping systems are created for you to make informed customer, marketing, pricing, and vendor-related decisions.

In this post, you will learn the tasks associated with a company’s accounting and recordkeeping system, considerations regarding who should do the work, and the differences between an accountant and a bookkeeper.

We’ll also help answer an important question — should you hire an accountant?

Accounting Tasks

Successfully managing a small business involves managing your cash. Your accounting system is critical for knowing how much cash you have in the bank each evening and if you can meet your expected expenses.

Three general activities are required for setting up and maintaining an effective accounting and recordkeeping system.

- Setting up the system: Creating a process to track transactions and make projections can be accomplished using a notebook, spreadsheets, or accounting software.

- Entering transactions: Transactions entered may include sales made, cost of materials purchased, employee compensation and benefits, hours worked, rent, IT, insurance, office supplies, and other expenses paid.

- Reporting actual results or the projections of future results: Reports may cover the status of potential customers, sales made, sales made where customers have not yet paid, expense comparisons with the budget and same period last year, all sorts of tax reports, financial statements, and information needed to satisfy bank loan covenants.

To Outsource or Not?

When you set up your business, one of your first decisions is to determine who should handle these accounting activities. The three choices are to do it yourself, assign someone on your team to do it, or to outsource to a bookkeeper or accountant. Often with a start-up, you are the only employee and there are limited funds available, so initially the founder frequently does all the bookkeeping.

As soon as you have sufficient discretionary funds, you can consider outsourcing the task. The key is to decide if bookkeeping is the best use of your time.

You started your business because you are good at selling, developing apps, manufacturing a product, consulting, or whatever other activities produce sales. Is it more valuable to spend your time producing sales or doing bookkeeping? Unless you are in the financial services sector, it is unlikely accounting is your strength.

If you decide to outsource, there are two types of financial professionals to consider: a certified public accountant (CPA) and a bookkeeper. Each has vastly different skills and rates, and you will want to retain both, but for different tasks.

Certified Public Accountant

A CPA has been certified by a state examining board as having met the state’s legal requirements. These professionals are granted certain responsibilities by statute, such as the ability to certify financial statements, and may be held liable for professional misconduct.

Accountants, like doctors and other professionals, are both generalists and specialists. Accounting specialties include tax accounting, mergers and acquisitions, and nonprofits. You need to find the right match for your needs; at first this will mostly be general accounting work,

Depending on the market and work complexity, CPAs may charge $100 to $300 an hour. So, it makes the most sense to hire an accountant only for complex or high-value projects, such the quarterly financial reports (especially if you are required to give these to a bank or under a government contract), tax filings, ongoing or case-specific advisory services, or the financial section of your business plan. Until your company reaches several million dollars in sales, it is more economical to outsource these tasks rather having a full-time accountant.

To find a CPA, word of mouth is best. Alternatively, check out these two sites CPAdirectory.com and the National Society of Accountants.

Bookkeeper

Performing basic, day-to-day activities is best left to a bookkeeper. These tasks include gathering employee timesheets, submitting purchase-order invoices for you to pay, collecting customer payments, preparing bank deposit statements, and entering all the transaction information into your accounting and recordkeeping system.

Depending on the market and tasks assigned, a bookkeeper charges $25 to $35 an hour. Many small businesses retain a part-time bookkeeper to help set up their accounting system and enter all the transactions, until business growth justifies a full-time position. Even if you decide to do the bookkeeping yourself, you still may want a bookkeeper to help you set up the accounting system.

Bookkeepers with knowledge of other similar businesses will know which categories of revenue and expense are typical in your industry to track and report, thus saving research time and ensuring your system is set up most effectively.

To find a bookkeeper, ask an accountant for recommendations of bookkeepers they have worked with and vetted. You can also place ads in your local paper, on Craigslist or other such forums, or go to the American Institute of Professional Bookkeepers.

Don’t Outsource It and Forget It

Consider outsourcing to an accountant and/or bookkeeper if you do not have the time, skills, or inclination to do this work. However, bear in mind, this is not a situation where you hire these folks and then forget about the subject. It is your company, and the financial statements are yours. When you present the financial statements to a bank, file your tax return, submit invoices to a government procurement official, or any other such use, you will be the one signing the document.

Therefore, you will need some understanding of what is included. Review important materials and ask for explanations if anything seems unclear.

Key Lessons:

- An accounting and recordkeeping system is mainly for you, to assist in making good decisions; it is not primarily for satisfying government reporting.

- When deciding whether to seek accounting assistance, consider where your time is best spent.

- There are substantial differences in the skills and costs of hiring an accountant or a bookkeeper, so hire each where there is the best match.

Looking for more small business management advice? Check out some of Hal’s other posts on how to plan and run your business:

- How Much Cash Should a Small Business Have?

- 10 Smart Things to Do When Writing and Updating Your Business Plan

- 7 Critical Business Plan Mistakes You Need to Avoid

- How to Create a Nonprofit Business Plan

- When is a Good Time to Review and Renew Your Business Plan?

- 4 Sections Every Business Plan Must Have (And Why they’re Important)

- Why You Need a Business Plan (And the Best Style for You)

About the author: Hal Shelton’s business planning skills were developed as a certified SCORE small business mentor, corporate executive, nonprofit board member, early-stage company investor, and author of The Secrets to Writing a Successful Business Plan: A Pro Shares a Step-By-Step Guide to Creating a Plan That Gets Results. Suggestions for additional topics are welcome: email Hal directly from his website:www.secretsofbusinessplans.com.

You know that adding images to your email marketing campaign can help bring your message to life.

But do you know how many images you should be adding to your email campaigns? What about how to make sure your images will display correctly for the people you’re sending to?

Images have the power to make a lasting impression on your reader.

But if you’re not following a few important email marketing best practices, it’s possible your images could be having the opposite effect.

Here are 6 common image mistakes, and advice on how to avoid them in your next email campaign.

1. Straying from your brand

Every image in your email should reinforce your business values and brand. Look for ways to include your company colors and logo in images, so your contacts will immediately think of your business. While you’ll want to use original images whenever you can, there are also great sites you can use to find professional-looking stock photography that won’t damage your brand.

One of these companies — Big Stock — integrates with your Constant Contact account, allowing you to purchase high-quality stock photos right from your Constant Contact account.

If you’re already using Facebook or Instagram to share photos of your business, your accounts can integrate with the Constant Contact image library. Once this is set up, you can easily use the images you’ve shared on social media in your email marketing campaigns.

2. Getting your image size out of whack

Once you’ve decided which images to use, you want to make sure they fit in your email campaign. If an image looks too large or small, you can resize the image within Constant Contact’s email editor. If you’re having difficulty getting the image size right, you can also try cropping your image to a different size proportion.

For single column templates, your images should be no wider than 600 pixels (an email template’s width). Specify the image height and width for all images, and be sure to preview your emails on both mobile and desktop before sending.

3. Using the wrong file type

If you notice your image quality is distorted, check the file type of your image. Most of your images will probably be saved as either JPG files or PNG files.

While JPGs are often great for smaller images, they don’t work as well with images that include text. PNG files support text well and can fix some distortions that are caused by other file types.

Use this chart, to find out the best file type for your image.

4. Ignoring different display options

Remember that your email can display differently in various email programs — some email programs will even block images automatically.

This is why it’s beneficial to use an email template and insert your content, rather than simply uploading an image and using it as your entire email campaign.

One of the best ways to make sure your email can be viewed as you intended it to be, is to add a “View as webpage” link to the top of your email. That way, anyone who runs into display issues can view the full email the way you designed it.

You can easily edit your header to include this link within your Constant Contact account.

You should also add image descriptions to each image, which will show up even if the image is not displaying.

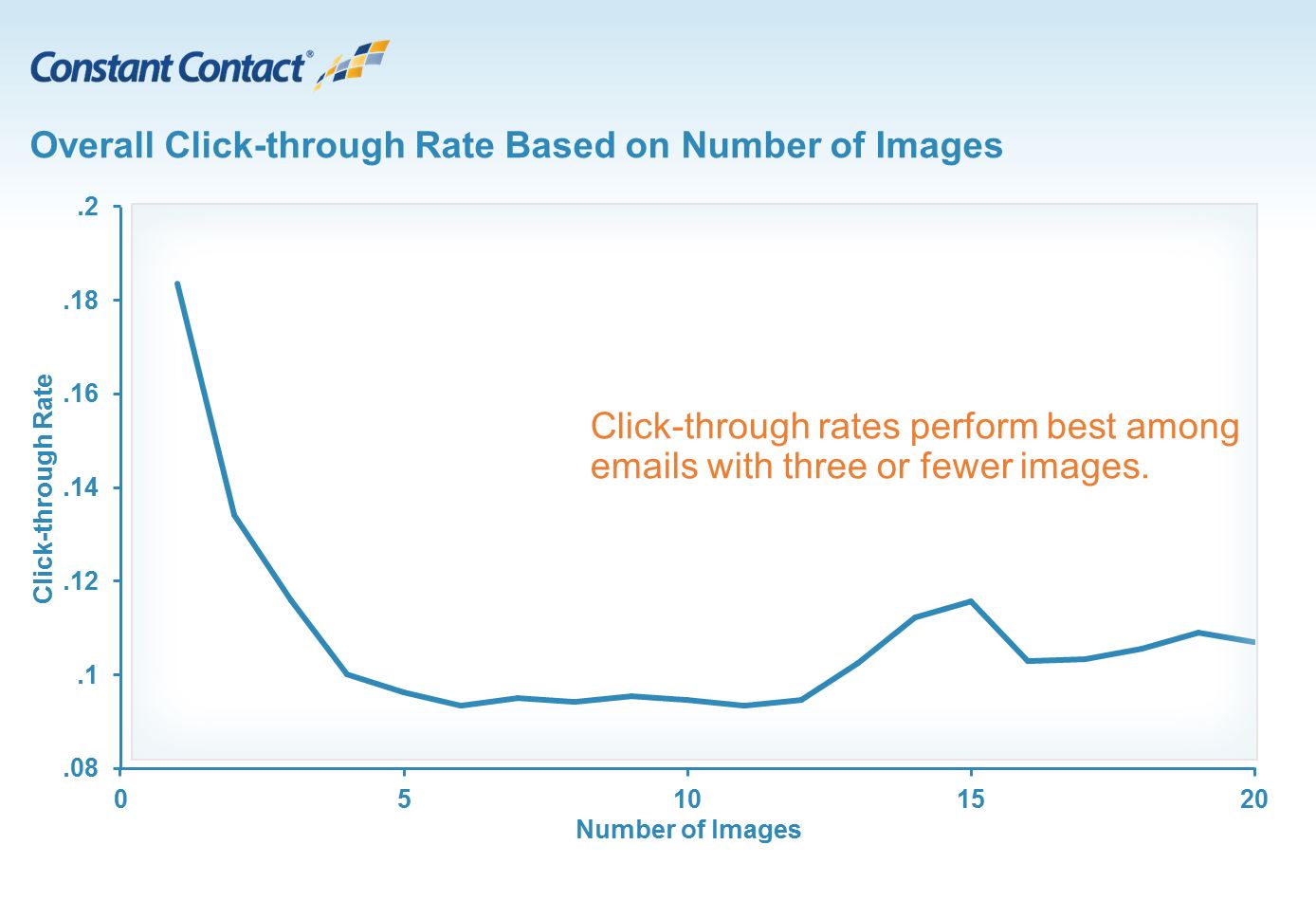

5. Using too many or too few

Have you ever wondered how many images to include in your email? We recently surveyed over 2 million customer emails to find out if there is a correlation between the amount of images included in an email and audience engagement.

We found that — with some industry specific exceptions — emails with three or fewer images and approximately 20 lines of text result in the highest click-through rates.

You can use these results as a guideline for designing your email campaign. Remember that this number can vary based on the type of message you’re creating and the information you decide to include. Just remember that with a growing number of people reading emails on mobile, you need to be clear and concise when designing your campaign and avoid overcrowding your emails.

Read more about how images impact email click-through rates here.

6. Not providing a next step

Images do a great job of grabbing attention, but make sure you know what to do with that attention once you have it.

Think about the action you want people to take. If you’re a nonprofit organization that’s hoping to generate donations — you can use an image to make a personal connection with your reader and include a button for people to donate online.

You can do the same if you’re trying to promote your products or highlight your different services. Just make sure you’re providing an easy way for people to take the next step.

Bring the power of images to your email.

With these tips in mind, you’re ready to add great-looking images to your email. You can start by seeing which images are getting the most engagement on social media and adding them to your next email campaign.

Provide a link after the image and see if you notice more people acting on the content you send out.

Put these tips to work today! Log in to your Constant Contact account.

If you have any image questions we didn’t cover, let us know in the comments below!

Using your fans to help you generate content for your website and social media can be a great tactic to show your business’s impact and save you time.

But if you’re going to use “user-generated content,” you’ll want to know the rules for doing so, so you can share your fans’ content without having to worry about things like:

- Is it legally correct for me to ask my customers to do this?

- Is it ethically ok to ask them to create content?

- Can I give out free products or even money to thank them?

The short answer is: YES! It’s ok to get your fans to help you by writing blog posts, adding product reviews, and sharing updates on social media.

The long answer, however, is that you want to make sure you’re following all the rules and guidelines as stated by the Federal Trade Commission (FTC).

Although the FTC does not monitor blogs, websites, or social platforms, they do field tons of consumer complaints each day about inaccuracy in advertising — and some of these claims are related to user-generated content.

Here are 6 simple rules to remember so that you can correctly use the great and authentic content your customers create for you.

1. If your customers are being paid in any way, they should disclose it.

Oftentimes, when you’re asking customers to share or create content for you, you’re not paying them monetarily and so you don’t have to worry about this rule. If you are paying a fan to write a review or create a blog post about your new service, on the other hand, this must be disclosed.

You always want to make sure there is no gray area around a customer authentically sharing content on your behalf and someone you have hired to create content.

You can most certainly pay customers or fans to create content; it just needs to be stated clearly that the customer is being paid for writing the particular piece of content. More on appropriate disclosures below.

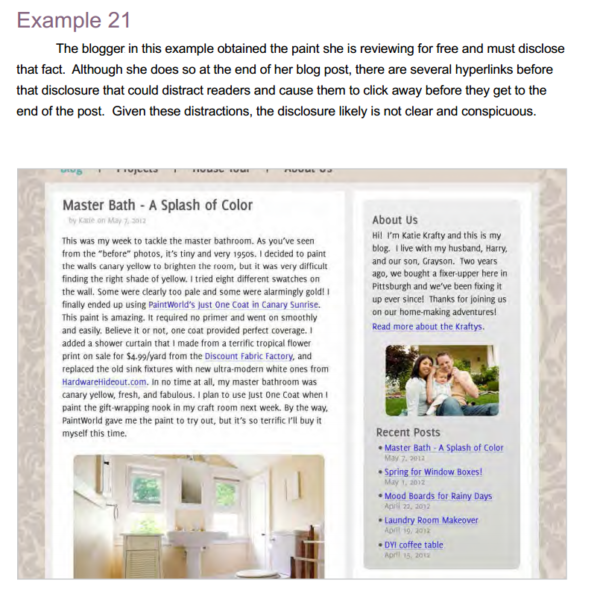

2. If your customers receive something for free and are writing/sharing about it, they should disclose it.

The FTC guidelines spend a lot of time talking about this. This use case often applies to a blogger writing a post or a customer writing a review. If a blogger is reviewing a product she received for free, she should clearly note it, preferably at the beginning of the blog post itself. BlogHer also recommends that if possible, the blogger should provide additional detail at the bottom of the blog post itself.

(Image: BlogHer)

3. If a share has been paid for, it should be disclosed.

Ok, you get the point. If money has been shelled out, it should be disclosed. There are clear guidelines around how you can disclose this fact, which will be helpful if you need to figure out how you include the details about a tweet being paid for within those 140 characters.

While in the past, brands would often use a hashtag to disclose that a tweet or post was an ad, this is actually not necessary in the new guidelines. It is much more important that the intent of the post is clear, which can be done just as easily by including the word “Ad” or “Sponsored.”

What is most important is that the intent is clearly stated and not hidden in some hyperlink or disclosure elsewhere. The disclosure also needs to be included in every tweet/post. Check out some more specific guidelines here.

4. Disclosures must be clear and conspicuous.

Whether the content is shown on a desktop computer, mobile phone, on Facebook, or on your website, any disclosure should be clear and easy to find.

All disclosures should be:

- Proximate to the information so the consumer does not have to hunt for it

- Of at least the same size as the message

- In the same format as the message

- Accessible on all platforms used

- Understandable to the consumer

5. The company is responsible for this content, not the fans sharing it.

I know, this sounds a little nerve-wracking. Remember, this only applies if you’re paying fans to share for you. You do not have to worry about this stipulation when fans are just sharing content you asked them to or creating content on your behalf.

A helpful example to look at is shoe retailer Cole Haan. They created a Pinterest contest with plans to incentivize the best photos on Pinterest with a $1,000 prize. The FTC ruled that Cole Haan should have told fans to appropriately note that they were sharing as part of this contest. There was no issue in running the promotion itself, just in the disclosure.

If you’re unsure, it’s always best to play on the safe side and just ask fans to disclose.

Image: Digiday, How To Avoid Legal Problems on Pinterest

6. Check in on a case-by-case basis.

There are a lot of cases that still exist where you’re unsure as to how you should disclose something. For example, what if a customer received a free product at some point and then decides to share something about the product on their Facebook Page later on?

Keep in mind, if you decide to run a big contest or ask your fans to create content attached to a prize, you might want to check with a lawyer first instead of getting yourself into hot water later on.

The FTC also recognizes that there is a lot of gray area, and with technology constantly changing, it can be difficult for it to keep up with all the marketing news updates. Do your best to nail down the basics, and seek help if you’re unsure about specific situations.

User-generated content can be a beautiful thing.

It can be free or inexpensive, it’s authentic, and it can generate powerful new exposure for your business. Before taking the plunge, however, make sure you know the basic rules and guidelines, so this content provides nothing but positive word-of-mouth about your company!

Disclaimer: I am not a lawyer and do not claim to be one, so this article is meant to be informational and does not include legal advice. Always check with a lawyer first if you’re uncertain on anything.

Ali Hyatt leads marketing and product for Upward Labs, which creates software for businesses to build and manage brand ambassador programs to drive customer engagement and increase revenue and reach. Upward Labs is a former resident inConstant Contact’s Small Business Innovation Loft. Read her previous posts here.

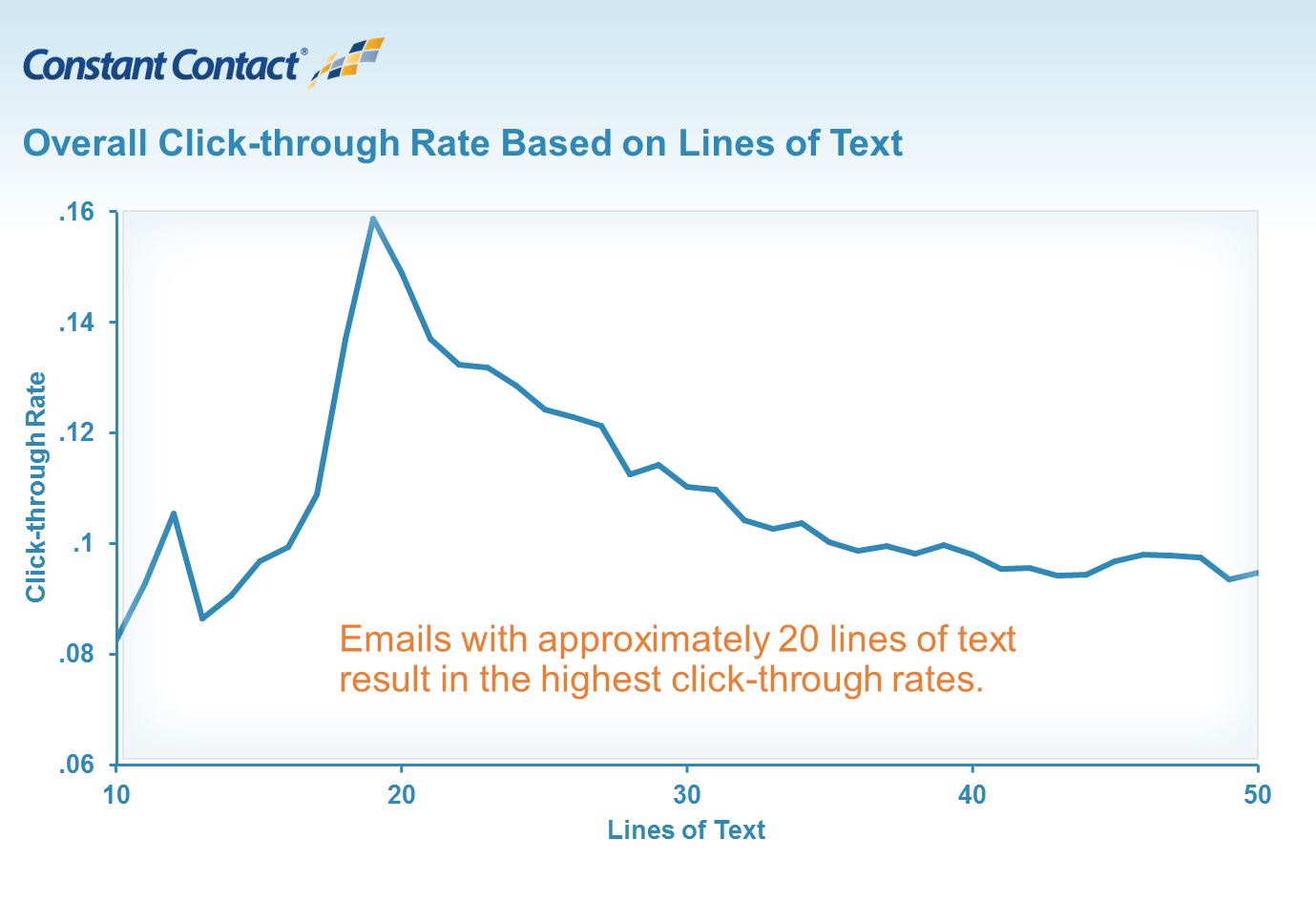

Email click-through rates are one of the most valuable pieces of data when it comes to measuring the effectiveness of your email campaign.

While open rates tell you how many people are seeing your email in the inbox and deciding to open, your click-through rate tells you how many of those people are acting on the content you send out.

Depending on the goal of your email marketing, a high click-through rate could mean more people visiting your website, redeeming your offer, or registering for an upcoming event.

Recently, we set out to learn more about what type of content works best for generating high click-through results.

Specifically, we wanted to learn more about how the length of text and number of images in an email impacts click-through rates, and whether or not there is an optimal amount that you should be using.

To help us find out, we analyzed over 2.1 million Constant Contact customer emails. To ensure that the data was accurate, we only analyzed campaigns sent to more than 100 subscribers.

We found that — with some industry-specific exceptions — emails with three or fewer images and approximately 20 lines of text result in the highest click-through rates from email subscribers.

Here is a closer look at the numbers:

What does this mean for you?

In today’s increasingly mobile world, consumers want to be able to read content anywhere, at any time, and from any device. These findings validate the fact that — in general — shorter more concise content performs better than longer, more convoluted email campaigns.

By keeping your emails straightforward and your content clear, you can craft emails knowing that your subscriber can read them with equal ease at their office desk, while waiting for the train, or at home.

Of course, it’s important to note that these findings represent what we’re seeing across a large spectrum of Constant Contact customers. It remains as important as ever to test to see what works among your own email subscriber base.

Next steps…

Take a look at your latest email campaigns — how do the amount of text and images compare to our overall results? Have you noticed any connection between the amount of text or images and your click-through rates?

We’d love to know what’s working for you and hear your ideas for improving click-through rates.

We’ll be digging deeper into this data over the next few weeks and uncovering some interesting industry trends, so stay tuned!