“I can’t wait to get more email today!”

Said no one ever.

So why would you ask, “Would you like to join our email list?”

This isn’t to say people don’t want to be on your email list.

It just means that more email isn’t exactly a reason for someone to let you into their inbox.

But what if you had a script that allowed you to ask for email addresses with more confidence?

When you know exactly what to say to emphasize the value your audience can expect to receive, you’ll have more people joining your email list. Which means more people to do more business with you in the future.

You should also know the answer to the following question.

Why do people sign up to email lists?

We asked consumers, and these are the top three reasons they join email lists:

- To receive promotions and discounts

- To receive exclusive content

- To show continued support for an organization

These reasons highlight the need to stay focused on providing value to your potential email subscriber.

Consumers want something in exchange for giving you their email address.

Keep this in mind as you answer the following questions. Once you have your script, modify it for the different places you can ask for email addresses.

Answer these four questions to create a script focused on the potential email subscriber.

- What would be enticing to a potential email subscriber?

- Are there any objections they might have?

- How can they sign up easily?

- What should they expect next?

Let’s answer these questions with a retail store in mind.

1. What would be enticing to the potential email subscriber?

Now that you know why consumers sign up, you can use that information as a starting point to decide what to offer in exchange for an email address.

Promotions or discounts. Consumers like to save money. If your business offers discounts or promotions, this is an excellent way to entice someone to join your email list.

Exclusive content. If you don’t offer discounts, think of your email list as a VIP club. What could you offer in terms of exclusive content that only email subscribers receive?

Support. Perhaps you partner with local businesses and hold events or activities that would be attractive to the potential email subscriber.

There’s also nothing wrong with offering all of these benefits to your email subscribers.

2. Are there any objections they might have?

There’s a bit of a risk for the person giving up an email address. They know that they are going to receive transactional emails. They may also worry you’re going to send them information that they’re not interested in. You’ll send them too many emails. Or maybe they think you’ll share their emails with someone else.

By identifying these objections, you can address them head-on to remove the risk. This means letting people know what they can expect in terms of frequency, that they can unsubscribe easily at any time, and that you’ll never share their contact information.

3. How can they sign up easily?

Where you’re asking — online, at an event, or in-store — determines what the customer needs to do to join your list.

For example, if you have scan-to-join QR code signage hanging around your store, they’ll need to use their mobile phone to sign up. If you have an online sign-up form on your website, they’ll need to type in their contact information.

4. What should they expect next?

Should they check their inbox for a coupon? Will they receive a welcome email with more details? Letting them know what to expect increases the chance that they’ll engage with your emails.

Let’s pull together a script you can modify for your business.

We’ll start with the idea that you or someone on your staff is face-to-face with the customer. Your answers to the questions above should help you write your script.

Scenario: Face-to-face with customer in-store.

The customer has had a great experience at your shop. This is the perfect time to ask for an email address, so you have a way to contact them again and get them to do more business with you.

Your script could go something like this:

Thanks for shopping with us today. Would you like to receive [enter details of your offer: % off your next purchase?; exclusive information for our VIPs?; details about events and offers from other local businesses?] I’ll just need an email address first.

In the future, we’ll send you a few emails a month with promotions, special events, and VIP exclusives. You’ll be able to unsubscribe at any time, and we never share your information.

[Customer says yes.]

Great! Enter your email address on the [sign-up sheet; tablet].

[Customer does so.]

OK, you’re all set. Check your inbox for an email with more details [be specific about the details if you can, for example: you’ll receive a welcome email with your coupon].

Now you have a script to modify.

Use the script above as is or modify it to fit the personality of your business. If you’re satisfying the questions above, you’ll find more people willing to give you their email addresses.

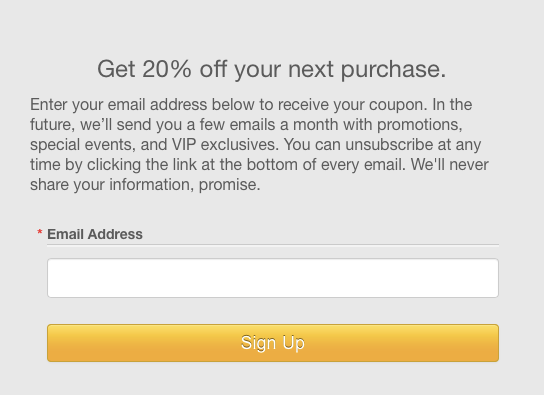

You can also modify the script based on the scenario. If you’re asking with an online sign-up form, for example, it would look like the image below.

Keep growing your email list

Use the tip above to grow that email list so you can grow your business.

Creating a balance sheet can be a challenging task for small business owners.

Especially if you’re not schooled in finance and do not fully understand the ins and outs of financial statements, you may feel uncertain at first.

In this post, I’ll cover what a balance sheet is, how it benefits your business, and the important sections you need to include.

Let’s get started.

What is a balance sheet?

A balance sheet is one of the three primary financial statements used to monitor the health of your business, along with your cash flow statement and the income statement.

Your balance sheet should be included as part of your business plan. Think of it as a snapshot of your company’s financial position — what you own and what you owe — at a singular point in time, like at the end of a month, quarter, or year.

The things you own are called assets, such as cash in the bank, inventory, vehicles, equipment, buildings, and accounts receivable, which is money customers owe you for sales made but not yet paid for.

The items you owe are called liabilities, such as accounts payable, which are purchases you have made but not yet paid for; taxes you owe, including sales, payroll, general purpose loans; and mortgages.

The difference between what you own (assets) and what you owe (liabilities) is called net worth, or owner’s equity. In other words, after all the bills have been paid and all obligations have been satisfied, any value remaining belongs to the owners.

What is the benefit of having a balance sheet for your business?

At a glance, the balance sheet will give you an idea if your business has the financial resources to expand and manage the normal swings in receiving and spending cash, or needs immediate attention to bolster cash reserves.

In terms of operational management, the balance sheet provides insights where cash needs to be collected, inventory managed, and bills paid.

How can you use a balance sheet to manage your business?

To use a balance sheet to manage your business, first look at your current and fixed assets.

Current assets can be converted into cash within the next 12 months:

- Cash in the bank: Keeping track of cash and projecting what it will be in one to four weeks lets you know if you have sufficient funds to make payroll, pay your bills, and pay yourself.

- Accounts receivable (A/R): You made the sale and incurred the cost of providing the product or service and are now waiting to be paid. Use your balance sheet to track if customers are paying on time, or if you need to call and remind them payment is due. If you know that customers are late on payments, you might consider holding off on subsequent sales. Some companies encourage prompt payment by offering a discount. The listing of when payments are due is called an accounts receivable aging statement. A financial ratio to help manage A/R is called days’ sales outstanding.

- Inventory: If your business has inventory, you need to ensure you can meet projected sales and not have too much left over. A manufacturing business might have three levels of inventory, each of which needs to be managed — raw material, in process, and finished product — while a retail clothing business needs to track inventory by style and size. A financial ratio to help manage inventory is called inventory turnover.

Fixed assets will be around for more than 12 months:

- Vehicles, equipment, and buildings: You need to track these for insurance purposes and probably depreciate the expense for tax purposes.

Now let’s look at your liability accounts.

The first three types of liabilities are known as current liabilities, as they are usually due within the next 12 months.

- Accounts payable (A/P): Having vendors that allow you to pay on credit is wonderful. Track these obligations, and make sure you pay on time. If that’s not possible, contact the vendor and let them know when you will make payment. Vendors often provide discounts for prompt payment, so if you have the funds, do not miss the payment date. Purchases charged to your credit card are included in this section.

- Taxes: Keep track of sales tax collected from customers. This is not your money; you are the tax collecting agent for the government. Payroll taxes withheld from employee paychecks are also not your money. If you are using a payroll service (highly recommended), they should be handling this for you. Some jurisdictions collect personal property and real property taxes, and depending on your form of legal organization (e.g., sole proprietorship, LLC, corporation), you may also have company state and federal income tax obligations.

- Loans: If you have any loans in which payments are due within the next 12 months, they are listed here. Do not miss any payment dates, as in some cases, this might cause your loan to go into default.

- Long-term loans: This includes mortgages where payment is due in more than 12 months.

A financial ratio that combines current assets and current liabilities is called current ratio (current assets divided by current liabilities). The ratio should be greater than 1, which demonstrates you have the financial resources to pay your bills.

The third section of the balance sheet shows your net worth.

Besides the personal satisfaction of knowing you are worth more each year, bank loans often have stipulations that net worth must be kept at a certain level, so you need to track your net worth to ensure you’re not in default.

Sample Balance Sheet

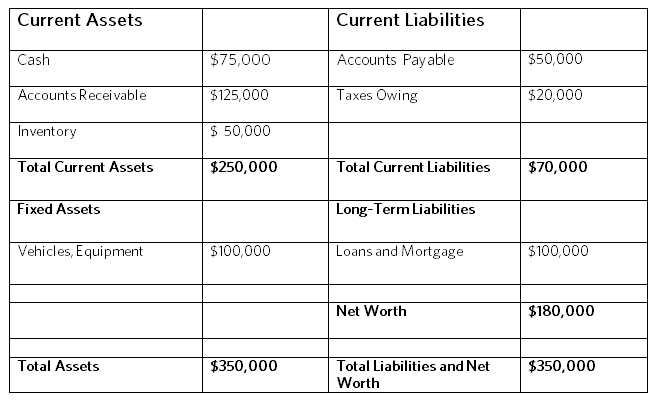

Here’s an example of a simplified balance sheet that shows a snapshot of a business on March 31, 2016:

Note that at $350,000, total assets equal total liabilities, plus net worth. From this example, we see that the $350,000 in assets has been financed with $170,000 from others and $180,000 from the owners.

Key Lessons

- The balance sheet is one of the primary financial statements that can be used to manage your business on both a long-term and daily basis.

- While you may delegate the preparation of the balance sheet to an accountant or bookkeeper, it represents your business, so you should understand how to read it and use it.

Looking for advice on small business management? You can read more posts from Hal here.

When I was in my twenties I launched my first business with only $100. Wild Women Entrepreneurs (Wild WE) was my platform for revolutionizing how women entrepreneurs built their businesses.

I was a struggling opera singer with a dream to turn my vocation into a career. Through hard work and my newfound community, I made it happen. I have performed around the world and currently serve as voice coach for some of the most talented vocal artists in America.

All with no money.

Wild WE also took me deep down the entrepreneurial rabbit hole. I’ve been launching and growing businesses ever since. In February, McGraw-Hill published my latest book on the subject. The Startup Equation: A Visual Guidebook to Building Your Startup is the first-ever, visually-based, choose your own adventure guide to the ins, outs, ups, and downs of turning one’s passion into a profitable small business.

You launched a successful business through the force of your own will. So what if you don’t have the financial capital to fund a marketing push and operational expansion? No excuses!

Here are three ways to get it done without any money.

1. Personify Your Brand

Branding legend Walter Landor said, “Products are made in a factory, but brands are created in the mind.” Factories cost money. You’ve already got your mind, so put it to work.

Figure out what your brand’s personified essence is. If your brand was a person, who would that person be? Customers don’t form loyal relationships with brick and mortar; they form them with people. Your brand must present as a person. Answer the following questions with brand-as-person in mind:

- What is your brand’s personality type?

- How does your brand act on a typical day?

- How does your brand get along with its customers?

When I launched Wild WE I didn’t do a professional branding until after I’d taken on clients. That was a mistake. Sure, I had a great feel for my brand but that’s a lot different than nailing it down on paper.

Eventually, I was able to nail down a personality characterized by excitement, along with dominant, lively, socially bold, and imaginative behavior. Nail down your brand’s personality before you do anything else. Doesn’t cost a dime.

2. Build a Community

As an opera singer, I had the voice. What I needed were opportunities to use it.

Individuals network. Since small businesses are usually extensions of the individuals who founded them, business-to-business networking is surprisingly easy.

After taking the time to build a community through Wild WE, my partners and I were able to help each other grow our existing customer base and scale. No need to pay for high-end marketing reports. Collectively, we had a treasure trove of information. We simply shared what we knew with one another.

Small businesses are also well-positioned to barter with each other. That can be anything from designing a new website or mobile app to a shared delivery service. When I was running Wild WE, one of my partners was a local coffee shop. (Let’s just say they had snappy content and I was extremely caffeinated).

Your community should also extend to your customers. Actively recruit customers to serve as brand evangelists. These are the people who promote you for free in conversation and on social media. Customers cross over to evangelists when you have earned their loyalty and given them a powerful and meaningful experience with your brand.

Ask yourself the following questions as you set out to build and leverage your network:

- Which of my partners can expose me to new customers?

- Which of my business expenses could be shifted to bartering relationships?

- How can I craft a compelling customer experience that will ignite customer loyalty beyond reason?

Wild WE was started with only $100. But it was also launched with a tremendous amount of social capital. That’s something that’s hard to quantify on a balance sheet, but it is invaluable to small business owners. Social capital is something you can build and leverage. Get out there and do it!

3. The Beauty of Barter

I am a HUGE fan of the barter system, particularly when it comes to growing a business. Apparently other people feel the same way, as there is a large movement of college students who have begun “swap days.” These students have organized exchange days where they bring old clothes or assorted goods to a central location, survey what others have brought, and arrange trades.

You can engage in similar practices by finding barter-partners on Facebook or Craigslist. Consider what you have to bring to the table, and what you need in return.

Both partners should feel like they are getting an even trade, otherwise the system fails. I once needed to have business cards printed, but I was very limited on funds. So, I approached a printer with the offer of a free ad on my website in exchange for cards. Grateful for further visibility, the business gladly accepted, and I walked away with 500 fresh business cards without dropping a dime!

So you’ve got the drive to grow your business, but no money to do it.

Stop with the excuses already. Put in the work (all it costs you is time) to personify your brand, build a community, and barter. The choice is yours. Start today!

To receive more great tips and tricks like this, download your complimentary copy of The Startup Launch here.

If you use Twitter, you should be taking advantage of its analytics platform to help you find out what your most effective content on Twitter is.

Here’s how to get started with Twitter Analytics and make smarter marketing decisions:

First, go to analytics.twitter.com and log in using your regular Twitter credentials.

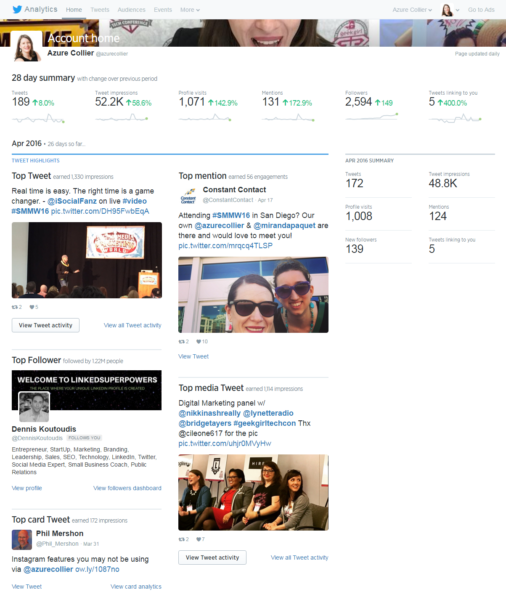

The first section you’ll see is your account home, which will give you a 28-day summary of how many tweets you’ve posted, the number of impressions those tweets received, how many visits were made to your profile, the number mentions you got, your current follower count, and how many tweets have been created that link to your profile.

Below the summary are highlights for each month. These include your top tweet, mention, follower, media tweet and card tweet, as well as summaries. Here’s an example from my personal Twitter account, @azurecollier:

Tweet activity

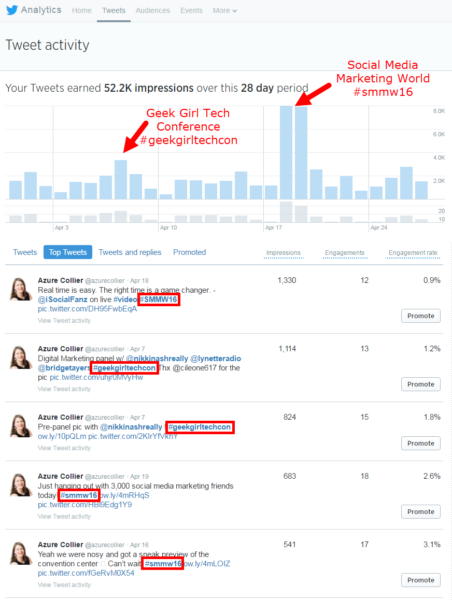

You can take a closer look at your content by clicking “Tweets” in the Twitter analytics menu. In this section, Twitter displays analytics for your tweets over the last 28 days, but you can select a different time period by clicking the Last 28 Days button on the top right side of the page.

The graph at the top shows you the number of impressions and tweets by day. Below the graph, you can click through a menu of your tweets arranged by four categories:

- Tweets – your tweets in reverse-chronological order

- Top tweets – the tweets that got the most impressions

- Tweets and replies – your tweets and replies by other Twitter users

- Promoted – any promoted tweets that you published)

Twitter will also show metrics for each tweet:

- Impressions – the number of times a user is served a Tweet in timeline or search results

- Engagements – the total number of times a user has interacted with a tweet, includes clicks, retweets, replies, follows, likes, links, Twitter cards, hashtags, embedded media, Twitter username, profile photo or expanding the tweet

- Engagement rate – the number of engagements divided by the number of impressions

Overall engagement metrics for the time period you select can be found on the right side of the tweets. These graphs show the engagement rate, number of link clicks, number of retweets, number of likes, and number of replies per day and on average over the time period.

How to use your tweet activity metrics

If you see spikes in your impressions, revisit the content you shared on those days to see what got the most impressions. For example, I can see that the top three spikes happened during the days I attended and spoke at Geek Girl Camp and at Social Media Marketing World. I participated in the conversations surrounding these conferences by tweeting and using the events’ hashtags.

Clicking on the top tweets category confirms my guess. You can see from this screenshot that my top tweets were from those events.

But don’t stop there. Check the engagement metrics for more information on what content is working for you on Twitter. Find the tweets in your top tweets that got the most engagement and compare them with your overall engagement metrics and the days that got the best engagement for each type.

Or you can export this data by clicking the export data button at the top of the Tweet activity page to get complete metrics and find out how many times Twitter users clicked links, retweeted, liked, and replied to each tweet.

Audiences

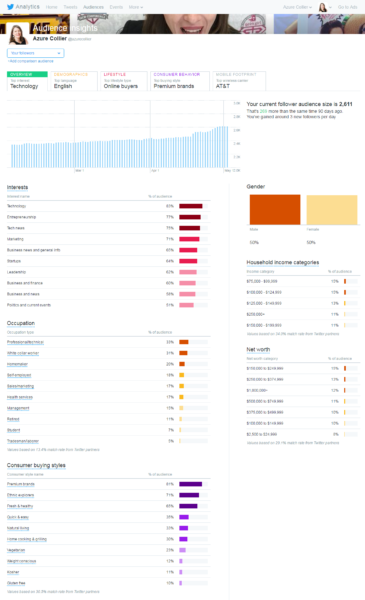

The Audiences tab in Twitter’s analytics platform provides you with a wealth of data about the people who follow your Twitter profile. When you go to the audience insights page, you’ll get an overall view of your follower growth for the past 90 days and information about your current audience.

When I look at my audience insights overview page, I can see that a majority of my followers are interested in technology, business, and marketing, which is exactly the kind of content I tweet about.

How to use your audience metrics

Dig deeper into these metrics by clicking through the tabs on the top of the audience insights page to learn more about the demographics, lifestyle, consumer behavior, and mobile footprint of your followers. This information can help you figure out what kind of information your audience might be interested in so you can create and share relevant content.

The demographics section will show you the gender, occupation, region, and income of your Twitter followers. The lifestyle tab shares information like interests, TV genres and political party affiliation of your followers.

Consumer behavior is a tab your business should watch closely for information on your followers’ buying styles (such as premium brands, fresh & healthy, or natural living) and the kinds of purchases they make (types of food and retail products). Check these sections regularly to determine if your business is reaching your ideal audience on Twitter.

Use Twitter analytics to take your tweets to the next level

When you spend some time reviewing your Twitter analytics, you’ll begin to notice trends that point to what Twitter content is working, what’s not working, and how to relate to your audience based on insights. These lessons will help you get the most out of Twitter for your business.

Looking for more online marketing advice?

Subscribe to our newsletter! Our Hints & Tips newsletter delivers the practical marketing tips and tricks you need to grow your business. Sign up to receive a roundup of our best blog posts, webinars, and resources — delivered straight to your inbox twice each month.

You dread it every year.

The busy season starts to wind down. The crowds begin to thin out; things get quieter.

And quieter…

How can you keep business from screeching to a halt during the long, slow offseason?

That was the challenge Donny and Jim Estes faced at Landfall Restaurant in Cape Cod. While business booms during the busy summer season, it’s a challenge to draw customers to their oceanfront location during the colder months.

In addition to traditional word of mouth and print advertising, Donny and Jim were looking for new, creative ways to draw crowds to their restaurant.

That’s when Donny decided to try some new strategies, using email and social media marketing.

“Email marketing and social media have been a great way for us to take word-of-mouth marketing to the next level,” Donny says. “Getting in front of our customers with relevant information about what’s going on at the restaurant is an easy way to get people talking about us to their friends, family, etc.”

“Our email list has now grown to not only include regular customers, but also new people who are interested in dining with us for the first time,” he says.

Let’s take a look at how Donny and Jim boost new and repeat business all year long:

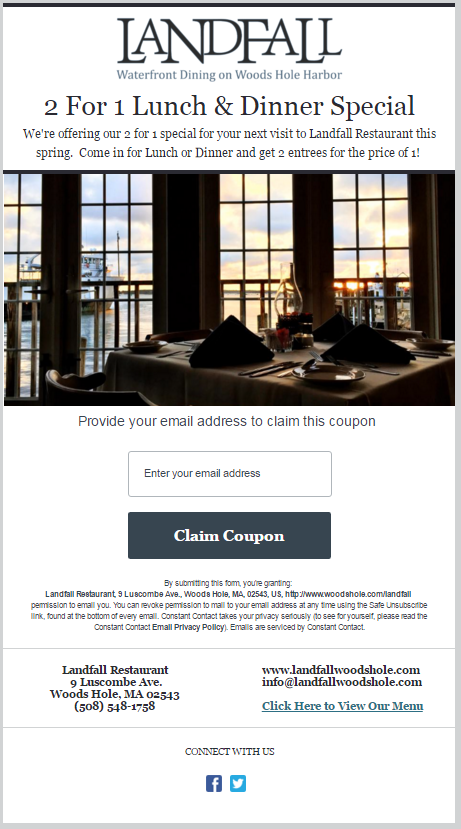

1. Create a custom coupon

Even if your business doesn’t typically offer special deals or discounts, you might have to work a little harder to draw people in during the offseason. Donny and Jim decided to try an enticing 2-for-1 Lunch and Dinner Special using Constant Contact’s Coupon feature.

Donny customized his coupon with an image from the restaurant and added in relevant contact information and social buttons.

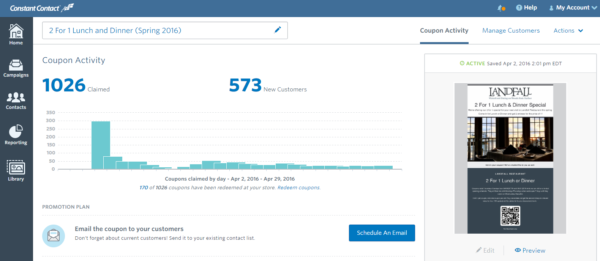

To claim the coupon, users had to provide an email address. Then, Donny could track the contacts that claimed, redeemed, and shared the coupon.

Tip: Find step-by-step instructions on how to create a Coupon within Constant Contact here.

2. Promote through social media

In addition to sending the coupon to his existing email subscribers, Donny wanted to reach a new audience.

He shared the coupon on his business Facebook Page to reach his social followers. New contacts were automatically added to the Landfall mailing list after claiming the coupon.

By bringing Facebook fans onto his email list, Donny now has a more direct way of reaching this customer base in the future. While organic reach on Facebook is dependent on an algorithm, by collecting contact information Donny has more control over how often his subscribers hear from him.

Donny also uses Facebook Advertising to reach a wider audience of brand new customers on Facebook. He uses his email list to target potential new customers that have traits and interests similar to the contacts already in his Constant Contact account.

Donny decided to create a Facebook Ad that was targeted at Facebook users who lived close to the restaurant. In total, the 2-for-1 coupon was claimed by 1011 people, resulting in 563 new contacts.

Landfall Restaurant accumulated a database of over 2,000 email addresses in less than a year by using this approach a few times.

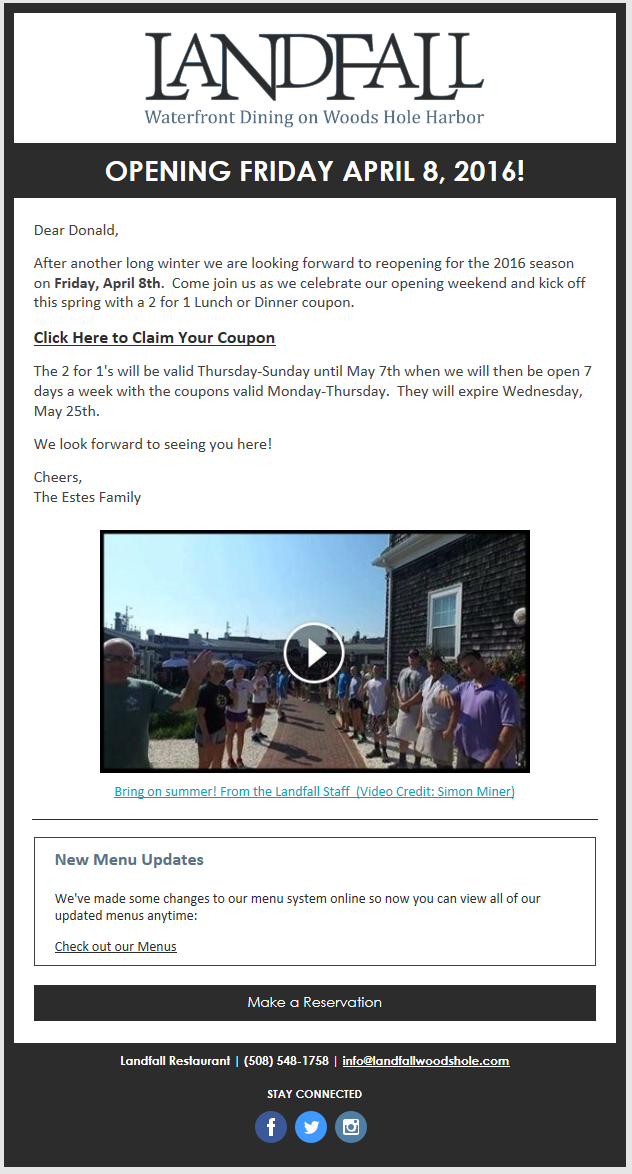

3. Turn email subscribers into repeat customers

With a quality list of engaged email subscribers, Donny and Jim are now able to regularly communicate with their audience and entice them to come back to Landfall all year long.

“The most important results we have seen through Constant Contact come from the number of people that we see engaging with the campaigns that we send out,” Donny explains.

“We have a high percentage of email followers who are opening the emails, clicking on the links, and claiming our coupons. Throughout the year we send out an email promoting a happy hour or live music event and Constant Contact helps to generate a lot of buzz getting more people to make a reservation.”

This year, to announce their season opening they sent an email with a special coupon and fun video, starring their staff members.

(You can check out the video on their Facebook Page.)

The email was enthusiastically received with an incredible open rate of 53 percent and a click-through rate of 48 percent!

It’s safe to say Donny and Jim have kept their audience engaged throughout the offseason and will be welcoming back many loyal customers this summer.

You too can reach customers all year long.

Whether your slow season starts in the summer, winter, or somewhere in between — the offseason will always be a challenging time for seasonal businesses. But with a strong marketing plan, you can reach customers all year long and get them geared up for your busy season.

Start today by jotting down an offer that you think would work well for your audience. Use these worksheets to identify marketing opportunities for your business. And then start plugging your important dates into an email marketing calendar.

Ready to get started?

Log in to your Constant Contact account.

Not a Constant Contact customer? Try a free, 60-day trial.

Learn more restaurant marketing ideas here.