It’s no secret that good customer service is your best competitive advantage.

There are dozens of best practices that help you deliver an exceptional customer experience, from engaging service representatives to fast, mobile-responsive websites. But can you precisely define — right now — who your customers are and what they want?

If not, every ounce of effort you put into product development, service tweaks, and marketing campaigns is a blind shot in the dark. Client satisfaction surveys can shed some light.

Get new clients and repeat business with all the tools and marketing advice you need, all in one place.

Why client surveys are important

With today’s near-limitless options, if customers don’t feel heard, they simply move on to your competitors. Consumers want companies to adapt to their desires — 79% say they’re loyal to brands that show they understand their clients.

As a business, this behavior not only cuts costs — brands spend five times more to attract new customers than to retain existing ones — but it also brings in higher profits. Research shows increasing your client-retention rate by 5% can boost profits by more than 25%.

But for those customers who aren’t happy, only about one in 25 actually complains to a company. Frustratingly, most people just disappear.

Client surveys fill this gap in understanding, helping you take the guesswork out of serving your customers and retaining their loyalty. Fielding client critiques isolates not only where you can make improvements but also where you can double down on what’s working well.

Building surveys that work well

While 77% of consumers favor brands that seek out their feedback, a survey’s effectiveness comes down to its design. Just like with your products and services, build your surveys with the customer experience in mind.

This means paying attention to survey:

- Length. Surveys that take about five minutes — about 10 to 20 questions — have the best response rates, and drop-off rates spike after that.

- Complexity. Keep it simple with questions easily understood by someone with an eighth-grade reading level.

- Breadth. Using simple yes or no answers is sometimes appropriate, but it limits what the respondent can voice — while overly complex or unnecessary questions can frustrate people.

Your communication matters, too. When sending a survey to customers, be sure to:

- Inform on what to expect, like how long the survey should take, how many questions there are, and if there’s a reward for participation like a discount code or small donation to charity on their behalf.

- Make your subject line relevant and actionable, so the receiver knows that giving their opinion will improve the service they can expect.

- Send reminders to people who complete only part of the survey.

- Thank respondents for their feedback.

- Follow up after the survey term has closed with how you plan to use this feedback.

Survey questions to avoid

Surveys can help a business understand what it’s doing right, offering valuable evaluation of current offerings. But criticism can be even more powerful. Honest, unfiltered customer feedback lets you identify patterns and issues that hold your business back, generating solutions that improve your clients’ experience.

While it’s often unintentional, poorly designed survey questions generate skewed and misleading responses. The way they’re written can leave little room for genuine opinions or accidentally guide answers based on what you want to hear.

Common issues with survey questions include:

- Absolute questions with yes or no as the only response.

- Leading questions that prompt the desired answer, like, “How much do you love our new product?”

- Loaded questions that make assumptions about a customer’s lifestyle, demographics, or experience with your company or your competitors — these often cause people to exit a survey if they don’t know how to respond.

- Multiple questions in one prompt, like, “Is our app functional, useful, and reliable?”

- Confusing questions, including those with double negatives like, “Was our product not unhelpful?”

It’s all about being clear and transparent, and inviting unedited opinions.

Defining your goal

Since you’ve only got about five minutes of a customer’s attention, your survey needs to be clear and to the point. You may segment different surveys among your customer base or issue multiple surveys throughout the year — but each one should have a narrow perspective, so it’s easy to collect and implement feedback.

What questions you ask in a survey depends on factors like:

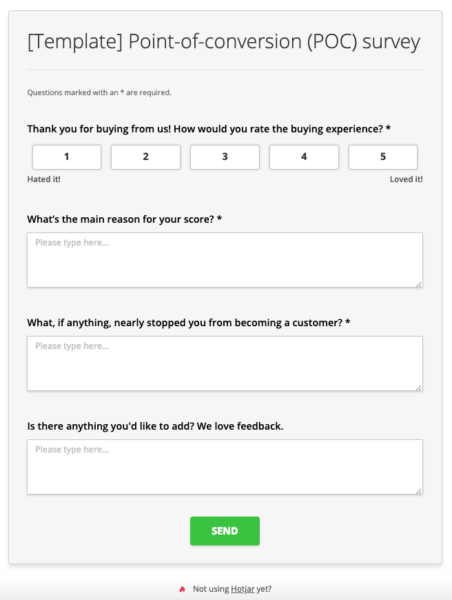

- Post-purchase opinions to measure customer satisfaction and service delivery, like a product satisfaction template or a set of customer experience questions.

- A Net Promoter Score (NPS) survey that weighs how likely a customer will recommend your brand. Templates are available that offer a good mix of targeted questions.

- Churn surveys that help you understand why a customer is choosing to take their business elsewhere.

- Development surveys to capture what customers want to see from you in the future.

Using QuestionPro and Constant Contact? Great! Get them to work together by connecting your Constant Contact account to QuestionPro with Zapier.

Or you could use a survey to guide more specific goals, like updating the user experience on your website or getting demographic insights for a new marketing campaign. Whatever the goal is, make sure it’s clearly defined.

Choosing the right questions

When designing survey questions, you want to strike a balance — ensuring you can get enough information to understand your audience’s pain points but reducing respondents’ required effort. Most customer surveys use a combination of these three question types:

Open-ended questions

Open-response questions let respondents include as much information as they want, not limiting answers to a set of predetermined choices. This means you learn more about your customers’ needs, and responses can shine a light on issues you hadn’t considered.

Make sure to avoid biased wording that can mislead answers, instead opting for neutral questions like:

- What problems did {product or service} help resolve?

- Why did you choose {business}?

- How would you explain {product or service} to a friend?

- What frustrates you about {product or service}?

- What expectations do you have of {product/website/service update}?

- What would you expect to pay for a new {product or service}?

Use open-ended questions sparingly in surveys, however. If there are too many to answer, customers get fatigued, increasing the chances that they’ll abandon the survey or offer less and less information in their answers.

Nominal questions

Nominal or multiple-choice questions work well if there are limited answers to a certain prompt. But you can also ensure you capture all possible answers by including an open-ended selection — or “other” field — among the list of choices.

Use them to get customer demographic, behavior, or lifestyle information like:

- Which of our {products or services} have you used in the past?

- Which best describes your job role (or marital status, income level, etc.)?

- When do you use {product or service}?

- Which {product or service} features are most important to you?

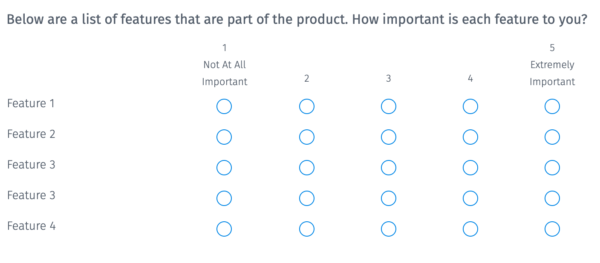

Scale questions

The darlings of customer satisfaction and NPS surveys, scale questions evaluate a person’s reaction or opinion to a given statement — and much more powerfully than a simple yes or no response.

This can include:

- A rating scale to uncover trends, asking for responses based on a 1 to 10 scale.

- A Likert scale to gauge opinions, with a range like “strongly disagree” to “strongly agree.”

Use scale questions to measure a specific opinion of the average customer, like:

- How useful is {new product or service feature}?

- How often do you use {product or service}?

- How likely are you to recommend {product or service} to a friend or colleague?

- How well did {product or service} solve your problem?

- How easy or difficult was it to solve your problem using {product or service}?

- On a scale of 1 to 10, how well did {product or service} meet your expectations?

Evaluate and edit for better response rates

A survey’s value is only as great as the response it gets. If you’re not getting useful insights from your client survey, or worse — no one is filling it out — reconsider what questions you’re asking so you can drive higher-quality responses and rates.

Our survey tool at Constant Contact makes it easy to track responses and general data trends to evaluate your efforts. You can easily see what works — and what needs improving — or chat with a marketing advisor to help craft a survey that adds value to both your business and your customers.