Financial advising is a personal business. From your clients’ goals to priorities, incentives, and anxieties — understanding them on a personal level is essential to serve their best interests.

But this knowledge used right can also tend to your bottom line.

This is because today’s financial consumers look for more personalization than ever. According to research from Accenture, your clients expect:

- Their core needs and values to be addressed

- Communication and advice shaped by their circumstances

- Getting added value from your relationship that’s customized and relevant

But you can’t accommodate a hundred different markets of ones. To offer each client the personal touch they want — without overextending your resources — you need to find the links that bring them together. That’s where client segmentation for financial advisors comes in.

Segmentation is about identifying these patterns and shared characteristics. Then it’s just dividing your base into smaller client groups.

These insights can inform everything from resource allocation to client management. It’s easier to tailor advice, products, and services for individual clients based on their similarity to others with segmentation.

This makes your job more efficient — and therefore, more profitable. But customizing communications by segmenting your audience also:

- Strengthens client relationships

- Helps with retention

- Attracts and converts new leads

The easiest way to show your clients that you get them is through their inbox — personalizing your relationship with segmented email marketing.

Get the expert marketing advice and tools you need to find new financial clients and increase investment from existing ones.

How financial advisors can use email segmentation

Clients want to hear from you. A study from Vanguard-Spectrem found that “a lack of proactive engagement” is one of the main reasons people switch financial advisors. Email marketing offers this engagement, strengthening your client relationships by:

- Positioning you as an expert, building their trust in you

- Adding extra value to your services, like content and advice addressing their current concerns

- Educating them on wealth management, driving sales as their priorities change

But for email marketing to build this connection — and net its average 4,300% return on investment — everything that lands in the customer’s inbox have to be relevant.

Put yourself in their shoes. Let’s say you send your entire email list a message about the best financial tools you offer for recent college graduates. Right off the cuff, you’re marginalizing everyone in your base who isn’t a recent grad. This doesn’t just annoy clients — it hurts your credibility with them.

Financial clients share their private information, goals, and dreams to help you better manage their assets. Sending them irrelevant content contradicts efforts to forge a trustworthy, personal connection.

By segmenting your contacts, you ensure the right people are getting the right communication, but it goes beyond that. This customized content also encourages heightened engagement — for example, segmented audiences are 50 percent more likely to click on the links you include over email.

Nurture, retain, and attract

Better relationships encourage client retention — a must for a sustainable business model in the financial world.

As a financial advisor, your engaged clients:

- Drive higher revenue over time

- Are easier to sell to

- Bring you more business through referrals

Attracting new leads is expensive — an average of $3,119 per client, according to Kitces Research. But while it boosts client loyalty, segmented email marketing also makes this client acquisition more cost-effective.

It works like this: When you connect to a new prospect, the information you collect matches them to the right segments. This makes it easier for you to send them relevant content straight away, which:

- Maximizes your profit on each acquisition

- Demonstrates to a potential client how you understand their needs

- Shows leads they can expect a personalized service if they choose you as their advisor

With tools like click segmentation, it’s even easier. The platform can trigger targeted messages to clients based on custom categories you set, like:

- Their priorities and financial goals

- Information on the most relevant services

- Where they stand in the acquisition pipeline

Timely, customized engagement converts prospects into paying clients.

Customer segmentation for financial services

You already have a lot of the information you need to start cataloging clients right in your files. How you organize these segments will be unique to your business, goals, and clients. For example, firms looking to bring in new leads might define one category based on current clients’ referral scores.

If you serve a narrow niche, this subgroup might be enough. But you can segment even further to customize outreach on a more and more personal level.

Let’s take your high-referral clients and create subgroups by occupation. This could show you’ve got a lead-generating segment of doctors. You can now develop content geared specifically to them, like an email about pension planning for medical professionals.

Compared to the subject line, “What everyone should know about pension planning,” this targeted, personal approach:

- Grabs the doctors’ interest, improving open rates

- Makes it more likely they’ll consider what you have to say or sell

- Encourages them to pass that information on to their colleagues — who then contact you

Categorizing clients

You’d give different advice to a millionaire client with eyes on a new boat compared to a new mom planning for her family’s future — why send them the same emails?

Using information from their individual profiles, you can start segmenting clients by traditional market metrics like:

- Age

- Gender

- Education history

- Occupation and company

- Location

- Marital and family status

These segments alone direct more effective email marketing with tailored recommendations, advice, and services for each group.

You can then add more dimensions to your segments based on what you know about their financial behaviors, like:

- Assets under management

- Value of outside assets

- Length of time as your client

- Lead or referral score

- Future profit potential

Then get even more personal by conducting client surveys. According to Accenture’s research, financial clients are very willing to detail and share their private information for better, more personalized communication.

Gather this goal-oriented feedback, like:

- Financial interests such as real estate, travel, or charity

- Plans — or dreams — for homeownership, children, or launching their own business

- What an ideal retirement looks like

- If they’re satisfied with current levels of things like insurance coverage, estate readiness, or tax planning

These responses don’t just ensure that each client’s profile is as comprehensive as possible. They can also inform better marketing strategies — from blog post ideas to email subjects they’ll click on right away.

How to conduct client surveys

Scale questions work great for evaluating a customer’s worries. With this format, you get a clearer look at client preferences, lifestyle, and attitude — as well as their current interest level in various financial advice and products.

This approach also helps uncover what keeps your clients up at night. On a 1 to 10 scale, assess your clients’ feelings about:

- Anxiety over future finances

- Satisfaction with the lifestyle their finances currently afford

- How likely they are to spend spontaneously

- Whether they tend to postpone financial decisions

- Their confidence in financial lingo

- How closely they follow financial news

Let’s say you have a segment with high anxiety about the future — you can send this group content related to products like term plans or retirement funds. If you segment this group by other criteria like age or occupation, you can get even more personal.

Or, if you have a segment that closely follows financial news, design a weekly industry newsletter that they’ll come to rely on.

Don’t be afraid to ask about hobbies and interests as well. You open up even more avenues to personalize outreach by categorizing clients under shared passions — whether it’s their pets, golf, or health and fitness.

A personal client connection, simplified

Personalization doesn’t have to be complicated.

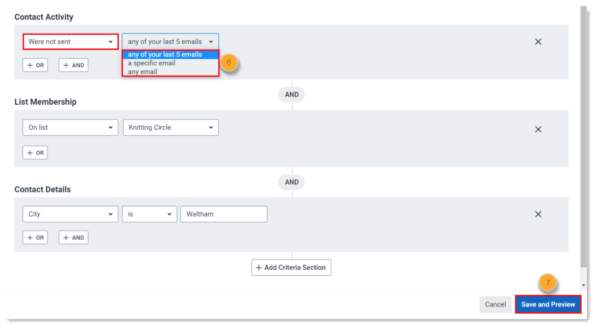

With digital marketing tools offered by Constant Contact, it’s all automated. Once you’ve mapped out your segment categories and criteria, you can:

- Build base lists reflecting high-level categories

- Tag contacts with up to 500 custom fields

- Create and send content designed around any combination of your lists and tags — giving you the flexibility to engage

- Add new leads to the right segments — and your acquisition email series — with just a few clicks

Constant Contact provides a guide that breaks the process down step by step.

From there, your cataloging gets smarter over time. If you send your clients content with clickable links, buttons, or images, click segmentation works to track their engagement behavior.

This means that based on what an email recipient clicks on — voicing their interest — they can automatically be:

- Sorted into the relevant list

- Tagged with custom criteria

- Added to an automated email series based on their engagement behavior

To learn more about client segmentation and other effective digital strategies and creative marketing ideas, check out Constant Contact’s The Download.