To get off the ground properly, your business needs a financial advisor marketing plan. Customers are more likely to find you online these days, so having a strong foundation in place is key. Luckily, there are digital tools available to help you build and maintain your online presence with ease. With the right tools, digital marketing for financial advisors doesn’t have to be hard. As a financial advisor, you can actually implement modern and meaningful marketing tactics on your own.

In this post, we’ll go over those digital marketing tools and some financial advisor marketing ideas that can help you grow your client base. Here are five steps you can take to begin:

- Build a website

- Utilize an email marketing tool

- Pick a primary social channel

- Keep business listings up to date

- Have an easy way to create content

Get the expert marketing advice and tools you need to find new financial clients and increase investment from existing ones.

Step 1: Build a website

Your financial services website is your online base — the hub of all the action. This is where you’ll point people in your efforts to drive business. Unlike social media sites, you own your website and your email list. If social media goes away tomorrow, you’ll still have this very important tool.

It’s also important to consider buying a website domain that matches the name of your business — you’ll have more long-term control and look more professional.

Make it mobile-responsive

People explore the web in a variety of ways now, from tablets to phones to computer screens, so it’s important to create a website that addresses this variety. In fact, over 40% of people use only their smartphone to browse the internet, and 58% of people finalize a purchase using their smartphone.

Having a website that works for any user — on any device — is critical to closing the deal. Mobile-responsive websites adjust their layout to fit the screen they’re viewed on, providing a smooth experience no matter what device is being used.

What goes on your website?

Your website needs at least four pages: Home, About, Services, and Contact. Your homepage is like your website’s front door — it draws visitors in. It should have all your social media buttons, newsletter sign-up form, and general information about what you do and who you serve.

Your About page tells your story and is your chance to make people care about you and your business. Your Services page will explain in more detail what you do. The Contact page is how you’ll connect with those who visit your site. A contact form, along with contact information, is imperative to enable visitors to reach out to you. You’ll want a newsletter sign-up form here too, as well as your social media buttons.

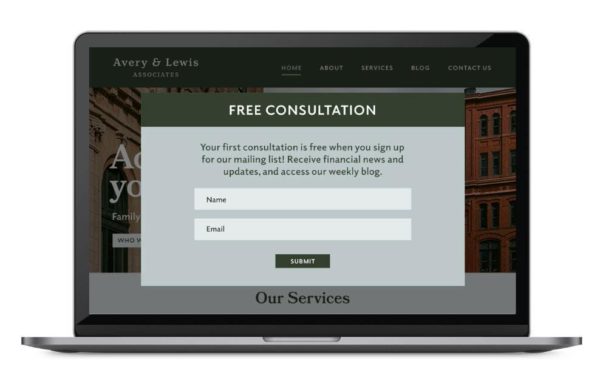

Use sign-up forms to help connect

With no way to know exactly who visits your website, using sign-up forms is a helpful way to establish a connection and collect visitors’ email addresses so you can contact them in the future. While your Contact page does this, not everyone sticks around your website long enough to see it. Consider a pop-up form or a prominently placed sign-up reminder to increase your chances of collecting their information.

Step 2: Utilize an email marketing tool

Email marketing for financial advisors is alive and well and is still one of the most effective marketing methods. Using an email automation tool like Constant Contact to handle your email marketing allows you to send relevant and timely messages that are targeted to the right people on your list.

Tips for sending emails

There are a few essential tips to consider when it comes to sending emails. The best time to send is right after visitors sign up for your list. At this point, they’re highly engaged and ready to continue the conversation. If you’ve attracted visitors with an offer for a free piece of content (like a guide), automation can send it right away along with a welcome email that shares more about your business and what you can do for them.

Sending a welcome email immediately upon sign-up helps people feel seen. A follow-up email a few days later can share more ways to engage with you, such as social media. By giving them more ways to connect, you’ll stay at the top of their minds and your business will get more exposure.

Then, find opportunities to continue to stay in touch with emails, from holidays to business events to helpful resources or reminders. These emails will show your contacts that you’re a valuable, trusted source of information. Eventually, you’ll be able to get more advanced with your automation techniques and send even more targeted emails.

Step 3: Pick a primary social channel

Social media is meant to help you engage with customers, spread awareness about your financial advisor services, and make it possible for people to share your business in a natural way. But social media can be overwhelming if you let it, and with all the channels available to your financial services business, it may feel like you have to use them all. But you don’t have to spread yourself too thin.

How to choose the right platform

To decide which social media platform is best for your business, think of the type of business you have and where your audience is. Each platform has a unique purpose and tone, so understanding them can help. Below are the main ones, listed in order of benefit to financial services providers.

- Because of your ability to target businesses, LinkedIn is the most popular choice.

- While it can be harder to get noticed on Facebook, it is still a worthwhile platform for sharing information with the general public and non-business clients.

- Twitter is a current-events feed, so it’s good for sharing the latest financial-related news.

- YouTube is best if you want to use video to share content, educate consumers, or bring your personality to life.

- Pinterest is a holding space for ideas and great for sharing blog posts. Most businesses can make use of it as a platform, but it isn’t as helpful for overall conversational engagement.

- You won’t likely need Instagram, as it’s better for image-heavy businesses like fashion or retail.

How to navigate social media marketing as a financial advisor

Once you’ve chosen your platform, be sure to reserve your business name on it and any social channel you may want to use now in the future. You don’t have to post on every platform right away. If you decide to be active on more than one platform, create a plan for each so you’re posting relevant content and engaging with your followers regularly.

Each profile can function a bit differently since each channel is different. For example, you’ll be more businesslike on LinkedIn and more familiar (but still professional) on Facebook. Avoid posting the same message on every channel, as this makes it feel less personal. Why would someone follow you on all your channels if you’re saying the same thing on each one?

Step 4: Keep business listings up to date

It’s important to pay attention to financial services listings and review sites. Whether you created the listing yourself or are claiming one to take control of the information, following them is important.

This is especially true of review sites — you never want to have a negative review without a response. Keep in mind, too, that many businesses neglect to thank reviewers who leave positive reviews — you should build in time to do this as well.

There are a few main sites to routinely monitor. These include:

- Facebook business page

- Google My Business

- Yelp

- Industry-specific sites

- LinkedIn company page

Because these sites are commonly used to search for your business, making sure the listings are accurate is the first step. Along with checking for accuracy, take time to flesh them out so your prospective clients know as much about you as possible, which helps build trust. And of course, make sure all these listings link back to your website.

Try to make sure your listing information is as consistent as possible across the sites. It’s also a good idea to include keywords that people would use to search for you so your listing gets picked up by search engines.

Step 5: Have an easy way to create content

Now that you’re up and running with a website, a social media presence, welcome emails, and control of your listings, you need to create content that’s worth sharing. Content is anything that people search for, consume, or share online. By consistently producing content that your audience is looking for, you’ll increase your chances of being found in searches.

A blog is a great way to showcase content. It connects to your website, but instead of showing visitors what you do, it shows them what you know. Keyword-rich articles that demonstrate your expertise will get you noticed — by people and by Google, which both help drive traffic. Having a calendar of topics will get you in a routine and let visitors know what to expect.

Take your financial advisor marketing to the next level

If you’re ready to focus more on digital marketing for financial advisors, Constant Contact can help. Whether you’re launching a new email marketing campaign, looking to build a website that stands out, or using social media to bring in more business, we have all the tools you need in one place.

With these tools and our expertise, you can achieve the results you want. Reach out today to learn more, or read about more financial advisor marketing tools in our guide, The Download.