Whether your goals for the upcoming year are to grow revenue or simply to maintain your current level of clientele, marketing your accounting business can help you achieve them.

Most of your new clients are online searching for you, and there are steps that you can take to help them find your business. In case you didn’t know, marketing for accounting firms follows the same principles as marketing for any other service-related business. And, digital marketing tools and advertising opportunities can help you use the internet to find new customers.

This article will cover several tools you can use to market your accounting business online. Including:

- Website SEO

- Listings and reviews

- Referrals

- Google Ads

- Social media

- Facebook ads

- Blogging

Marketing for accounting firms starts online

Your customers are already online, and you should be too. Whether your website just needs a bit of a refresh or a total overhaul, use these tips and techniques to start the new year off on the right foot.

Website search engine optimization (SEO)

Your website is your primary marketing tool, and in a crowded market, you want to keep it at the top of search engine results. Making sure your website includes the keywords people are searching for, a tactic called search engine optimization (SEO), is a great way to make sure your website is turning up when people are looking.

You can see how your business stacks up against the competition by trying various searches. Use search engines like Google, Yahoo, and Bing to see what comes up when you search for your company or for the services you offer. You may find that you are listed far back in the search results. If this is the case, it’s time to update your website copy to include keywords that will improve your place in search engine results.

Local SEO

Along with searching for your business by name, type in various phrases that customers may use to find you. If you’re a tax accountant, type in “Tax accountants in (your city)” and see who ends up at the top of the search results. Google places listings for businesses that have paid for advertising at the top of the results. Scroll past the paid companies and then find your business.

If you aren’t at or near the top of the first page, you can take steps to move your business up. Local SEO involves optimizing your website and other digital tools in a way that makes it easier for people in your area to find you. The easiest way to achieve local SEO is to make sure that your location is clearly listed on your homepage, tags and meta description (the small string of text that appears under your website in search engines).

Listings and reviews

If you have an office location, be sure to sign up for Google Business Profile, Apple Maps Connect, and Yelp. These tools let you manage your address, business hours, offerings, and reviews. To set up a Google Business Profile listing, type in https://google.com/business. Click the button that says “Manage Now” to enter all of your business information, including your meta description.

For Apple Maps Connect, go to https://mapsconnect.apple.com. Create an Apple ID (if you don’t already have one), sign in, and then follow the steps to claim and list your business.

To set up your business on Yelp, go to https://biz.yelp.com. Click the button that says “Manage my free listing” to get started.

Customer reviews not only help your local SEO, they also help to build your trust and credibility for people who are looking for you on the internet. Many potential customers use reviews to get an idea about your business before deciding to come to you for accounting services.

You can make it easy for customers to review your business by adding a plug-in to your website that takes people to Google or Yelp to read a review. If someone leaves a negative review, remind yourself that they’re providing you with an opportunity to let your customer service skills shine and to potentially improve the way you do business. So, address the reviewer’s complaint in a professional manner. Apologize, if appropriate and, if needed, you can rectify the issue directly with the customer — offline.

Referrals

For service providers, referrals are a great way to generate word-of-mouth marketing and attract new customers. If your goal is to grow your business, encourage referrals from both your employees and current customers. Easy methods for implementing this strategy include handing out extra business cards to your current clients and encouraging them to share your business on social media. You can also add a call to action to your email signature encouraging referrals.

When asking for referrals, it’s a good idea to offer something in exchange, like a free business checkup. Think about what you might be able to offer as a reward for a referral.

Google Ads

Companies who pay for Google advertising are not only listed prominently in search results, but their businesses also pop up during various web activities. Google Ads help build your visibility and lead to a larger audience for your business. This strategy is very cost-effective for smaller accounting firms with lower marketing budgets. Google lets you set your budget with options to pay per month, per day, and per ad.

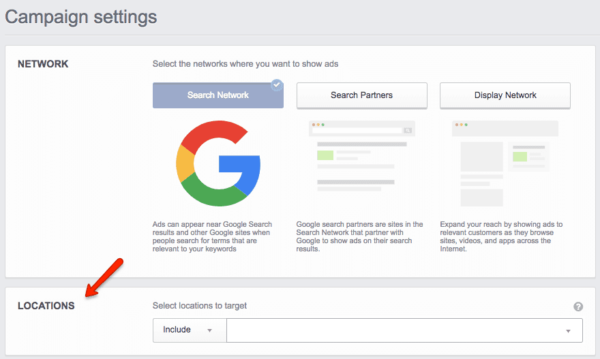

For this strategy to be effective, make sure that your ads are targeted to the right people. Google lets you choose your audience from a drop-down menu. Targeting strategies are different depending on your company and your desired customers, but your ads should always be locally targeted unless you are planning on expanding your business beyond your local area.

Google Ads work on a PPC model. Pay-per-click (PPC) advertising is a strategy in which you do not pay for your ad until somebody clicks it.

To increase the chances of your ad being picked up and placed highly in the Google search engine, make sure that your ad is optimized to clearly communicate your business objectives to customers. In addition to having an optimized ad, optimized web pages and pages with relevant keywords tend to score higher in Google’s pool of advertisers.

Social media

Social media is an important and cost-effective marketing tool you can use to engage with current clients as well as to find new ones. Creating engaging posts keeps people coming to your page and helps build your credibility.

Three social media platforms that you should use for accounting marketing include Facebook, Instagram and LinkedIn. Setting up a Facebook business page is easy. Type in https://facebook.com/business. Once there, click on “Get Started” and follow all of the steps for setting up your business page.

Setting up a page is not enough. Once you have established your page, it should include regular posts of engaging content. As a method to build up your credibility, use your company’s Facebook page to share relevant articles in the industry. It’s also a good idea to share tips and tricks that your customers can use to make the accounting process go more quickly. You can also use this platform to share resources people can use to solve their business accounting problems.

If you’re having a hard time keeping on top of engaging and creative social media content Constant Contact offers tools for creating interesting and engaging posts that will drive people to your page.

Facebook ads

After you’ve set up a business page to help market your accounting firm, you can take your strategy to the next level with Facebook ads. Like Google Ads, Facebook lets you tailor your budget, so this strategy doesn’t have to be expensive. Make sure you have a business account set up, and you can create your ad strategy right from that page. The platform has a variety of tools that you can use to develop your ad.

You can choose whether you want to build an audience or broaden your reach. Once you have determined your objective, choose where to run your ad, set your budget, and decide the format. You can run a photo, a video, or a slideshow.

Ads are targeted based on algorithms, making it likely that the people who see your ad will already have been looking for an accounting firm. After your ad has run, Facebook has analysis tools to help you determine how well the ad did. You can use these analytics to revise your strategy or run an ad that targets a different group of people.

Blogging

Blogs are a great tool for keeping your website fresh and at the top of search engine results. Once you have your blog set up, be sure to post regularly.

Like social media, blogs help you build your expertise and credibility with clients. When you can showcase your industry experience while adding keywords to your blog, your company ranks higher in search engines and your audience will be more likely to trust you with their business.

Level up your online presence to reach more people today

Digital marketing tools are essential for attracting new customers to your accounting business because they can help you capture the attention of potential clients while they’re browsing online.

Tools like Facebook ads and Google Ads help you catch them when they are looking for your specific services. Platforms including Yelp and Google Business Profile help you target people within your area and let clients read reviews about your business. Social media platforms and blogs allow you to engage your clients and build a bigger network.

Learn more about how to implement these and other digital marketing strategies with The Download for professional services.